When you turn 65, you have some important decisions to make about your Medicare benefits. You must also make these decisions within a specific time frame. It’s important to understand your choices, and the timeline by which you must make them in order to avoid penalties. Normally, most Americans become eligible for Medicare benefits when they turn 65. The process …

The Biggest Money Mistakes Retirees Make

The abundance of investment options that are available to us as we plan for a financially secure retirement can be daunting. Some retirees take too much risk and fail to plan for longevity. Here we look at the biggest mistakes retirees make, and how you can avoid them. Taking too much investment risk Many retirees overestimate their investment acumen, or …

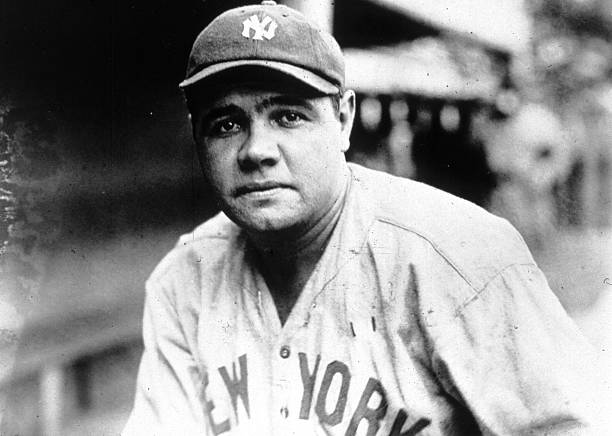

Babe Ruth: The Sultan of Safe Money

George Herman Ruth had a lot of bad financial habits. He spent too much, he spent frivolously and he fumbled away his earnings power to some degree. But the Babe was shrewd in one important aspect: The annuities he bought protected him for life. That purchase proved to be one of the best decisions Ruth ever made, once the Great …

Best Time to Get a Reverse Mortgage? Wait or Act Now?

You might be surprised by how many people are utilizing reverse mortgages. Borrowers come from a wide variety of socioeconomic backgrounds and ages range from 62 to 95 and older. One thing everyone struggles with is when is the best time to get a reverse mortgage. While there is no one right answer, below are a few guidelines to help …

2020 Laws Affecting Your Estate Plan

Estate planning laws change from one year to the next. Anyone who is doing estate planning for the first time in 2020 should especially be aware of the current laws, and it is also helpful for people who have planned before but are not sure about current rules to update their knowledge. These are some of the most important tips …

Criminals Target Seniors with Covid-19 Scams

One of the sad realities of an emergency is that there are people who come out of the woodwork to take advantage of others by seeking to fleece them of their money or steal their identities. During the COVID-19 crisis, scammers are as busy as ever, and they are using this opportunity to especially target seniors, believing that they are …

Protect Your Retirement Against A Bear Market

Over the long run, the stock market has been a historically reliable generator of wealth for generations of investors. Over the short run, things are a lot more dicey. In fact, for investors who are relying on their investments for retirement income, a stock market crash at the wrong time can be devastating to individual financial plans. Here is a …

Reverse Mortgages: A Powerful Tool During the Pandemic Crisis

For many Americans, home equity is the single largest component of net worth. It can be a valuable contributor to retirement and financial well-being, especially during this pandemic and extraordinary time of monetary strain. The current economic conditions might make this a particularly interesting time for a reverse mortgage. What Exactly is a Reverse Mortgage? A reverse mortgage is a …

Coronavirus and Life Insurance, What You Need to Know

If you have life insurance and are concerned that it won’t pay out in case you pass from COVID-19, you can rest assured your loved ones will receive a payout. If you have not yet purchased coverage, it’s not too late. The good news: Life insurance is still very much available and, according to trade publication reports, there was a …

What to Do If You’re Worried About Stock Market Volatility

A volatile stock market is fine for the 20- and 30-somethings. It’s a different matter for people approaching retirement. Your retirement nest-egg should be a source of security and comfort to you. It shouldn’t be something that makes your blood pressure spike. If recent volatility is worrying to you, it may be time to take some action. The current coronavirus-driven …